Well, here’s some good news: sometimes, you should use the roommate’s earnings to increase your odds of financing approval. In this blog post, we will discuss brand new ben.

Great things about an excellent Co-Signer on the Home loan Blog post

If you are looking to shop for a property otherwise refinance on your current house, you may possibly have issues about being qualified due to a position, income, loans, borrowing from the bank, and other situations personal loans Richmond OH. Depending on your role, that have an effective co-signer on your financial you will definitely h.

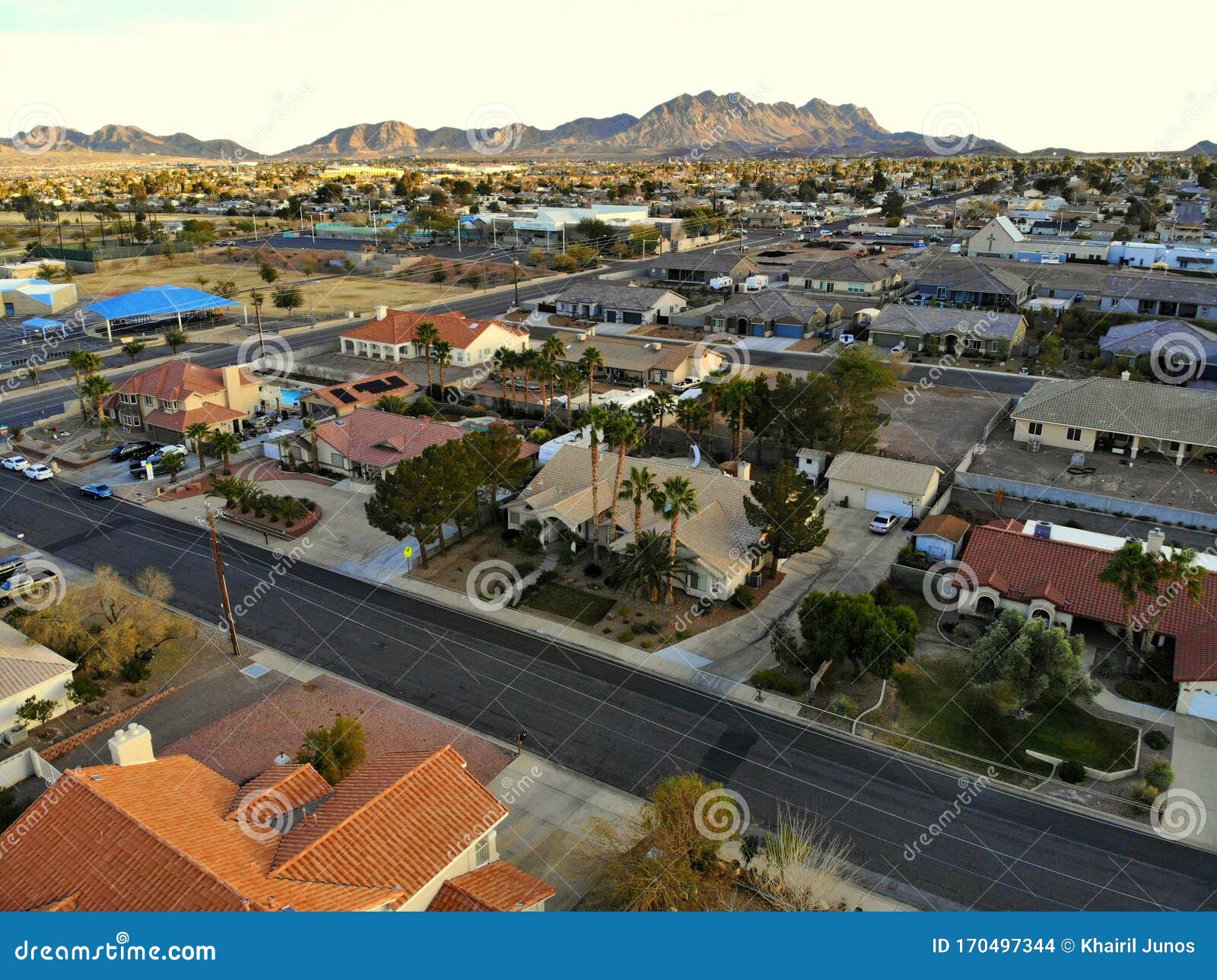

How School Districts Impact Your own Home’s Value Post

With respect to to buy a home, prospective people think several products including venue, places, and neighborhood qualities. Among these, the grade of the school area commonly takes on a critical part regarding the decision-making proc.

Advancement Compliment of Deals Blog post

Advancement Due to MarketingYou can get the support in our greatest-level, in-household in order to improve your company, strengthen and produce relationship and cultivate previous, pending and you can upcoming customers. All of us requires your vision and desires an excellent.

Brilliant and you can Delicious Orange Buttercream Cupcakes Post

Vibrant and you will Delicious Orange Buttercream CupcakesWelcome sunny weeks and you can springtime environment with the help of our vibrant and delicious lemon buttercream cupcakes, the ultimate Easter recipe. Lemon CUPCAKES 3 glasses care about-rising flour&nbs.

Turn on the newest barbecue grill that it Work Go out weekend! Blog post

Turn up this new barbeque grill which Work Day weekend!This Labor Time, you will want to merge some thing right up a little while and attempt aside it grilled pizza pie. Which have planning and grill day totaling just 28 moments, its easier than you possibly might imagine! Crazy A beneficial Grilled PizzaIngredients.

Do you recently buy a house that have Bucks? Here is how you might put some funds back into their wallet! Delay resource allows you to easily accessibility security in your home and you can discovered a giant part of your money right back. This is how they works.

Private Financial Borrowing regarding TowneBank Post

Discover Homeownership which have Towne Family Advantage Towne House Virtue brings qualified people $2,five hundred in conclusion cost direction. Qualification & Guidelines:Number 1 quarters onlyNo first-date buyer requirementMinimum 3% down-payment requiredI.

Springtime is close to here, which means it is more about as the busiest time of the year for buying and you may offering home. Have you been considering getting your home in the market? The answer to a successful household product sales try ensuring that your own family pulls the newest wid.

Pick Your ideal Loan Suits Blog post

Look for Your perfect Loan MatchThis Valentine’s day, swipe directly on homeownership. While you are an initial-day homebuyer, most of the financial terminology and conditions will likely be tough to understand. Whether or not you are not a first-big date visitors, it will sti.

- tiktok

- Home Pick

- Purchase Another type of House

- Mortgage Pre-Qualification

- Real estate Process

- First-Big date Household Visitors

- House Re-finance

- Household Refinancing

- Cash-Aside Re-finance

Links and you will blogs are being provided for educational aim simply. Coastal Towne Financial does not have any control of any other webpages and you will struggles to endorse, make sure or display posts, availableness, views, goods and services that are available otherwise shown on people website other than this. This is simply not a connection so you can give. Coastal Towne Mortgage was a mortgage broker. A broker percentage is generally charged into the representative service.

When interest levels normalize and you can converge additionally the second market for home loan try totally consolidated, the fresh new led borrowing from the bank system including SBPE may gradually getting phased out. This new FGTS program, and this serves a lesser money bracket (come across Annex 7), are nevertheless needed for the time are given that a main resource o f property money financing, particularly if you find yourself choice subsidies (instance new PSH initial subsidy program) can’t be well enough funded to allow a much bigger proportion o f lower income homes the means to access homes financing having an initial subsidy. Regarding the medium term, FGTS could possibly get attention even more on the character while the an excellent provident fund instead of since seller o f seriously sponsored borrowing. FGTS was slowly thinking of moving a clear and you will efJicient method regarding getting subsidies.