The fresh new Intricate Nature from Pre-approval

Which have founded the essential build of what pre-acceptance entails, you will need to delve into their detailed characteristics and why it try a very significant relationship from the mortgage app process than simply pre-degree.

- Comprehensive Credit assessment : Unlike pre-qualification, pre-acceptance pertains to a difficult query in the credit file. Lenders tend to closely test your credit history, credit rating, and you can people activities which may impact your loan qualifications.

- Verification away from Economic Suggestions : During the pre-recognition, the lending company verifies debt guidance, including your income, a position standing, property, and you can present expenses. This task is essential inside the choosing the real amount borrowed you can afford together with interest rates relevant.

Pre-approval: A great Conditional Home loan Connection

A great pre-approval letter might be thought to be a green light having a great financial, but it’s crucial that you know it’s a great conditional union. The final recognition try susceptible to specific conditions, instance a reasonable possessions assessment and no high alterations in the money you owe.

Pre-recognition emails normally have a substance months, usually 60 to help you 3 months. This time around physique offers a clear screen to locate good house and then make a deal to your assurance your capital was tentatively protected.

Just how Pre-recognition Benefits Your Homebuying Excursion

- Negotiating Fuel : Having a beneficial pre-recognition page in hand, you are in a healthier standing to discuss which have sellers. It demonstrates you’ve got the backing out of a lender and are happy to follow the get.

- Subtle Family Search : Once you understand simply how much you could potentially acquire helps narrow down the domestic look in order to functions aimed along with your funds, and then make your pursuit more beneficial.

Preparing for Potential Pressures

The new intricate credit review throughout pre-acceptance normally reveal problems that make a difference to your loan terminology otherwise capability to get approved, providing an opportunity to address these problems in advance of finalizing a property pick.

Understanding the outlined character away from pre-approval clarifies as to why its a critical step in the loan process. Its more than simply an enhanced version of pre-qualification; its an intensive analysis one to set this new tone for your whole homebuying experience. From the wearing pre-recognition, you position yourself since the a life threatening buyer, armed with a definite comprehension of your financial potential and you can limitations.

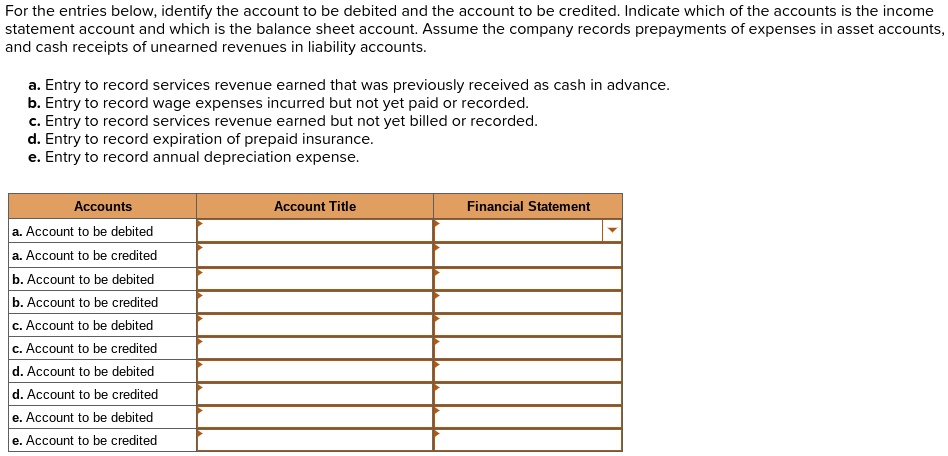

Secret Differences when considering Pre-certification and you will Pre-recognition

Understanding the difference between pre-approval and pre-qualification is not only from the understanding the meanings; it’s about gripping how for each phase has an effect on the way of buying a property.

Thus, to include a definite comprehension of just how pre-qualification and you will pre-recognition disagree, the following is a quick investigations highlighting the trick attributes:

Why the newest Difference Things

Understanding the difference in pre-degree and you will pre-acceptance is over a straightforward educational do it; it offers practical effects to suit your homebuying excursion. Which differentiation is vital for some reasons, for every single impacting the method that you means the acquisition of your home.

Setting Sensible Criterion to possess Economic Thought

The fresh homebuying travel starts with pre-degree, taking an earlier imagine of your own credit skill. This step support place a simple budget for your residence browse. But not, it’s the pre-acceptance that provides a more precise and credible indicator of one’s economic capabilities.

Accepting it huge difference is vital to own making plans for your funds and you may domestic browse predicated on affirmed information rather than just quotes. It assurances your financial believed was grounded in the realism, getting ready you toward real will cost you and you will responsibilities of shopping for a great home https://clickcashadvance.com/personal-loans-pa/.

Boosting Trustworthiness in the Housing market

In terms of getting together with manufacturers and real estate agents, a beneficial pre-acceptance letter rather elevates your own position. In lieu of a great pre-degree, a good pre-approval suggests you’ve gone through a tight economic vetting processes and are also a serious consumer, willing to proceed with a buy.