Contents

From experience, a trader can make good profits with swing trading and at the same time be able to use day trading for some of his or her day trading profit opportunities. Many people who want to trade stocks prefer swing trading because of its low commitment and limited risk. Swing traders buy stocks to sell them later when the market has moved higher.

There are certain differences between margin trading and leverage trading, and these differences can have an impact on whether a trader decides to choose day trading or swing trading. Day traders have lower margin requirements primarily because they combine high-turnover trading strategies with high leverage. Swing traders, on the other hand, use lower leverage to minimize risk exposure since their positions are open for longer, meaning that the margin requirements in swing trading are higher. Day traders execute multiple trades, often with multiple assets, within a day. This approach is designed to take advantage of small price fluctuations throughout the day. Conversely, swing traders usually have a single trade that can stay active for weeks.

And, these returns come quickly because swing traders enter and exit their position in as little as a few days. As such, you can make swing trading a great source of secondary – or perhaps even primary – income. Seeing a good success rate with swing trading is entirely feasible and actually quite simple.

They don’t actually use software to help them make emotionless decisions, they don’t follow sound strategies or principles, and they don’t have the right mindset. While the principles behind swing trading are simple, consistently executing a winning strategy over the course of a year is not easy. But after we discuss the average swing traders’ success rate, we’ll talk about what you can do to increase your chances of making consistent profits through this style of trading. Before going any further, we want to provide a quick overview of the swing trading strategy itself. In this article, we’re going to address these two questions and evaluate the average swing trading success rate as a whole. Maybe you’ve been on the fence about trying this investment strategy out yourself.

Momentum trading strategy

In normal conventions, if the securities price goes above the level of 70, it is in the overbought zone; otherwise, if the security price is below 30, it is in the oversold zone. Usually, when the securities go beyond the support or resistance level, the situation is preceded by a low volume of trade. Therefore, in this situation, the volume of trading increases manifold.

You are willing to take fewer trades but more careful to make sure your trades are very good setups. Swing trading is best suited for those who have full-time jobs or school but have enough free time to stay up-to-date with what is going on in the global economy. Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. From basic trading terms to trading jargon, you can find the explanation for a long list of trading terms here.

Swing Trading with Moving Averages Crosses

The services and products offered on the website are subject to applicable laws and regulations, as well as relevant service terms and policies. The services and products are not available to all customers or in all geographic areas or in any jurisdiction where it is unlawful for us to offer such services and products. In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission and a member of Financial Industry Regulatory Authority /Securities Investor Protection Corporation .

- Furthermore, if the security falls in the overbought zone, then it is most likely to reverse into a downtrend and vice versa.

- Swing trading relies heavily on technical analysis, an understanding of price channels, and uses simple moving averages.

- The market is very volatile right now so use Multi HODL to activate your crypto and capitalize on this volatility.

- The reversal may be upward or downward and can be determined using the Fibonacci trading ratio.

It maximizes short-term profit potential by capturing the bulk of market swings. Swing trading exposes a trader to overnight and weekend risk, where the price could gap and open the following session at a substantially different price. However, that’s not to say that one is inherently better or more profitable than the other. No trading strategy is foolproof and no strategy can ever offer a one-size-fits-all approach to trading profitably.

But to summarize, this strategy entails capitalizing on short-term or midterm swings in a stock or commodities price. Swing traders rely primarily on technical analysis to uncover opportunities and time their entry/exit. Swing trades occur over the course of a few days – or in some cases, a few weeks depending on how patient the trader is. This strategy is typically employed by those looking to earn supplemental income.

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. After entering a swing trade, place a protective stop reasonably close to your entry point. Stops and money management are essential for your survival and success.

With swing trading, you need a thick skin and the mental fortitude to ride out short-term fluctuations. With this strategy, a trader tries to capture the big impulse swings in the direction of the trend. The strategy tends to give good profits when gotten right, but it has a poor winning rate.

In addition, you should only start trading once you have well-defined entry and exit strategies. We’ve seen estimations that as many as 90% of swing traders fail to make money in the stock market – meaning they either break even or lose money. That suggests that the average swing trading success rate is somewhere around 10% – meaning 10% of swing traders actually bring in profit over the course of a year. Keep in mind that the vast majority of traders treat it more like gambling.

Swing Trading vs Investing Long Term: Which Approach Best Suits You?

A https://en.forexbrokerslist.site/ trading style, by contrast, may have a few transactions some days and nothing on others. Positions can be checked periodically or handled with alerts when critical price points are reached rather than the need for constant monitoring. This allows swing traders to diversify their investments and keep a level head while investing. More importantly, swing trading doesn’t demand the same level of active attention as day trading, so the swing trader can start slowly and build the number of trades over time.

Continue to do due diligence and https://forex-trend.net/ research on the best securities to hold; while it may seem like every security is a winner, this won’t always be the case. Plan on holding back some capital you may otherwise be trading in the event that securities you are holding do suffer material price declines. Instead of holding for weeks, be prepared to have quicker turnaround on securities you are holding. Swing trading sits in the middle of the continuum between day trading to trend trading.

Why risk management is critical in swing trading

All of these strategies can be applied to your future trades to help you identify swing trading opportunities in the markets you’re most interested in. Once you have undertaken your research, decide which asset and time frame you wish to swing trade. Also, determine your entry and exit strategy based off your swing trading signal. For example, to buy AAPL when the price hits the support level. The cup and handle is another favorite chart pattern swing traders use to find trading opportunities. This pattern is considered a bullish signal, indicating the continuation of an upward price movement.

That’s why we’re going to take a deep dive into the debate of swing trading vs investing long term. AvaTrade provides vast resources to boost your trading education as well as superior and intuitive trading platforms to implement your strategies and trading knowledge. Open an AvaTrade demo account to test the above strategies, or a live account when you feel ready, and get started with swing trading. When using channels, it is important to place trades only in the direction of the main trend.

https://topforexnews.org/ trading is contingent on market conditions, though there are different trades for every market type. Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. Using a historical example, the chart above shows a period where Apple had a strong price move higher.

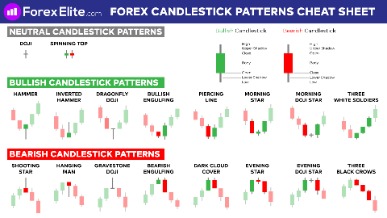

On the other hand, reversal patterns such as double tops as well as head and shoulders indicate that the momentum of the current trend is fading and the price is likely to change direction. Reading price action using candlesticks can help traders identify high probability swing trading opportunities in the market. Indices are statistical measures designed to track the performance of baskets of related stocks.

It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. In scalping, traders enter into multiple trades during a trading session where they hold securities for a very short time spanning a few seconds or minutes.

There are a variety of methods traders use to capitalize on market swings. Swing traders are exposed to gap risk, where a security’s price changes while the market is closed. Swing trading is a speculative strategy where investors buy and hold assets to profit from expected price moves. If you’re considering swing trading, you’ll need to have the skills required to analyze charts and numbers to be successful. Moving average convergence/divergence is a momentum indicator that shows the relationship between two moving averages of a security’s price.