- Replace your credit score: Repay outstanding costs, create money on time, and prevent obtaining several loans at a time.

- Provide collateral: For those who have worthwhile possessions used just like the collateral, this will raise your likelihood of protecting a loan.

- Raise your earnings: If possible, enhance your income if you take https://paydayloancolorado.net/la-junta-gardens/ with the a lot more functions otherwise selecting means to earn much more.

- Keeps a substantial plan: That have a clear policy for how you will make use of the loan and just how you are going to pay it off can make you more desirable to lenders.

- Get an effective co-signer: When you have individuals with a good credit history that is happy to co-sign the borrowed funds, this will enhance your likelihood of recognition.

Individual money lending are a form of investment where some one otherwise individual dealers, perhaps not finance companies, lend currency to individuals, typically to possess an initial-label period, to finance a certain endeavor otherwise get. In the place of old-fashioned lenders like finance companies, individual currency loan providers are not institutionalized and generally are typically somebody otherwise short groups of dealers that trying high output on the investment.

Private money credit are used for many different aim, particularly home financial investments, business funding, otherwise personal loans. New terms of private money loans usually are flexible and can become designed in order to meet the needs of the debtor and you can the financial institution.

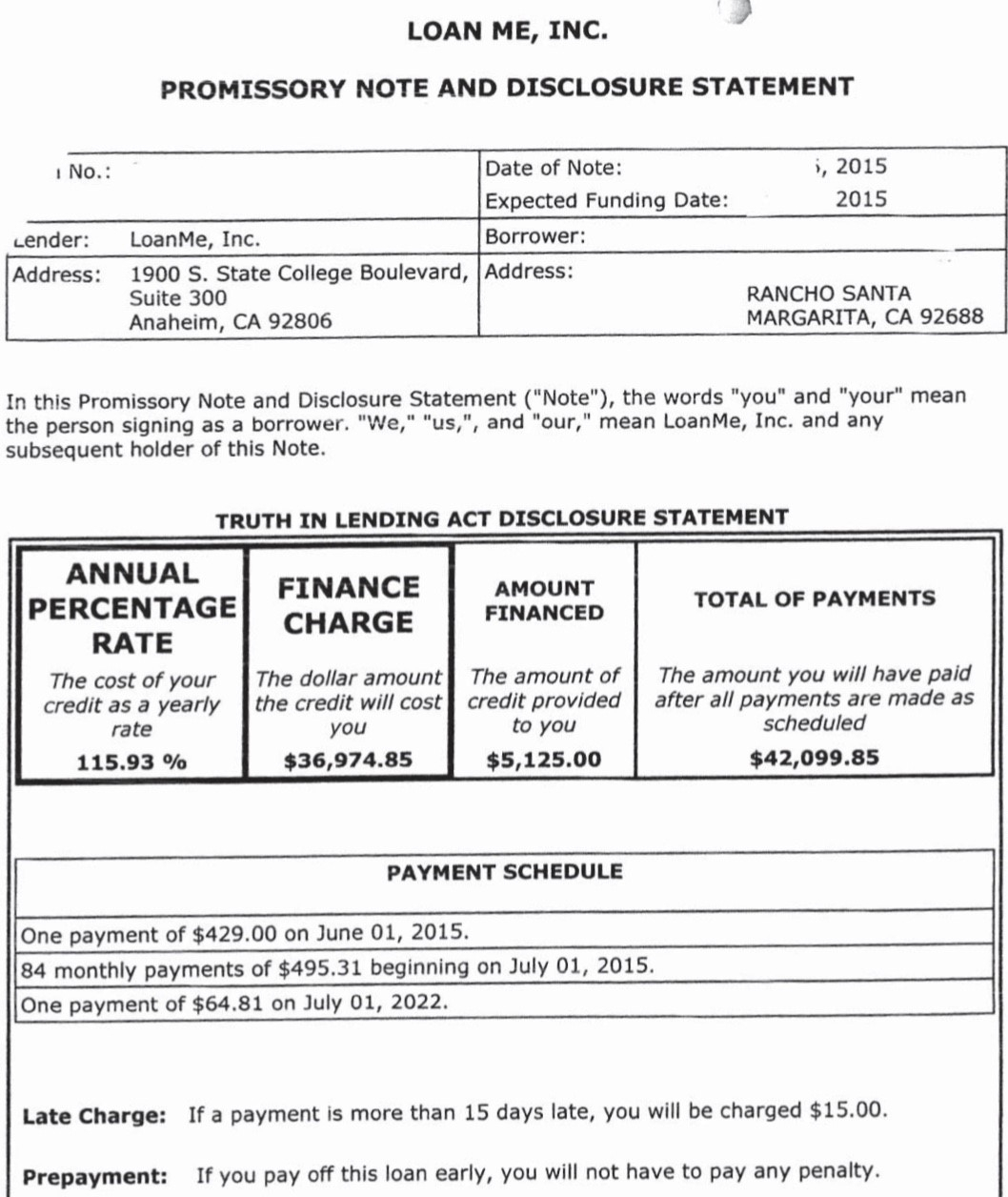

Individual currency lending will be a practical choice for consumers which was indeed rejected by old-fashioned lenders on account of bad credit or insufficient equity. Although not, personal currency finance tend to have high interest rates and you will costs compared to the traditional fund, just like the individual loan providers try using up a higher level off exposure.

Overall, private currency credit are a useful source of financial support to possess borrowers who require access to easy money, but it is crucial that you very carefully think about the words and prospective threats for the such fund before agreeing so you can obtain.

The necessity for individual money lending comes from the reality that conventional credit establishments such banking institutions, credit unions, or other creditors provides tight lending criteria that will not getting came across by all the consumers. Such organizations usually need a premier credit history, security, and you may an extended application techniques. Additionally, old-fashioned lenders ount required by the brand new borrower.

Whom spends personal currency financing?

Personal currency lending fills the new gap left by the old-fashioned loan providers from the delivering financing options to consumers which will most likely not qualify regarding conventional loan providers. Personal loan providers usually have much more flexible credit conditions and can offer funds more quickly than simply traditional loan providers. Personal money loan providers are also able to offer book financial loans that will never be available using conventional lenders.

One more reason why individual money financing may be needed would be the fact it can provide a high return on investment getting lenders. Personal loan providers can earn large rates on the assets opposed in order to antique investments for example carries or securities. Which highest profits on return is going to be appealing to anyone or communities that happen to be trying to invest their funds.

What exactly do I must show for the greatest terms to possess individual money credit?

For the right terminology to own personal money financing, you ought to demonstrate to loan providers that you are a low-risk debtor that is likely to pay back the mortgage towards some time entirely. Listed below are some steps you can take to change the possibility of getting an educated conditions:

- Has actually a very clear policy for how you would utilize the financing finance and exactly how you’ll pay-off the mortgage.

- Enjoys a robust credit rating and get. Personal lenders commonly generally speaking look at the credit history to decide your own creditworthiness.